International business finance the operations of local enterprise finance management much more complex, tricky and challenging process. Various considerations and factors affecting the financing of the company's international identity as the nose. Most of these factors are positive. For example, the newer, wider, more flexible tools for more effective use of financial resources to and financial resources to reach a greater variety of what I like. On the other hand, financial operations various risks, they enter the domain of new limitations and obligations. Consequently, the international financial business of the duty of the administrator, two-way operation becomes: to minimize the financial risks of the company, and to maximize opportunities to take advantage of the new international environment has to offer.

VENTURE CAPITAL–PRIVATE EQUITY FOR ALMOST ALL

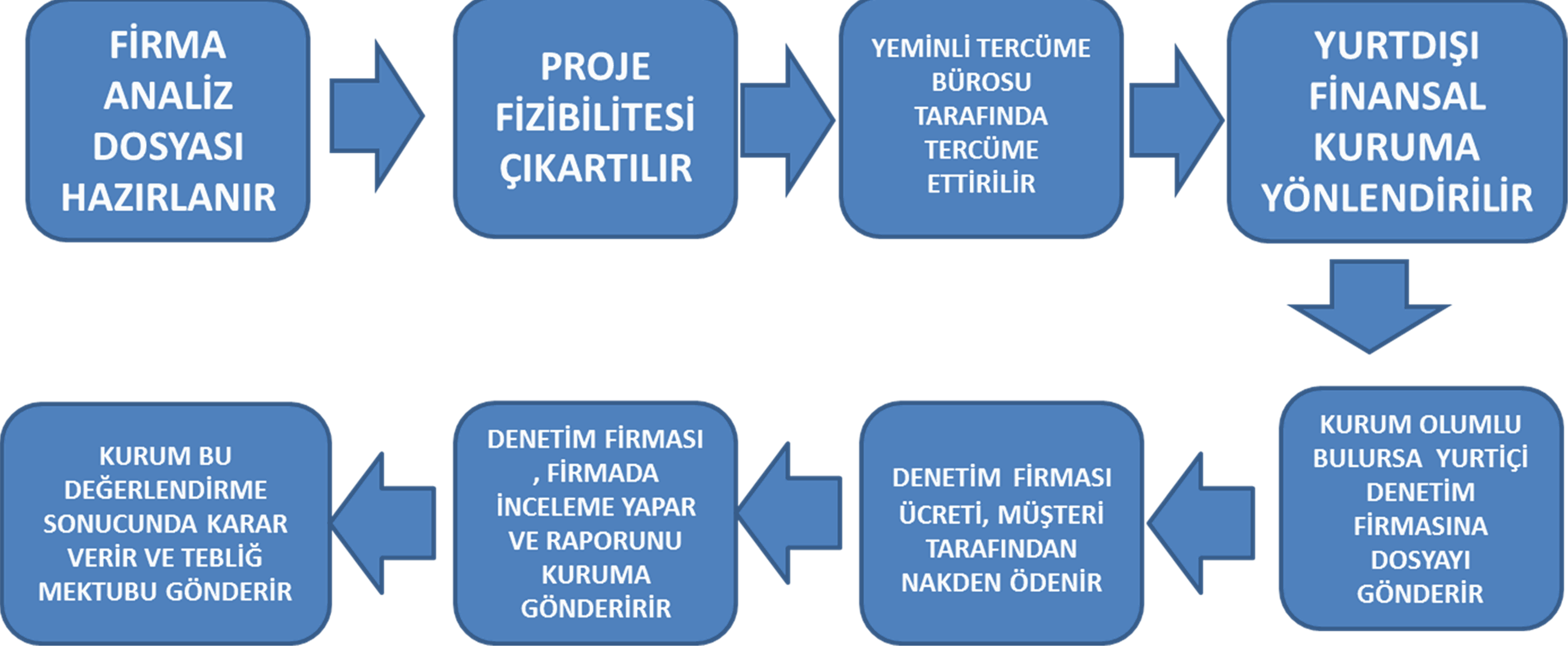

To be able to rapidly adapt to changing business conditions and expansion is required to have a strong capital structure in order to achieve their goals. Pre-financial resources are sufficient to some degree within the company now, when firms are in need of external financing sources. Companies with foreign investors, strategic investors and private equity firms to INPRO in the sales process-MANAGEMENT experience experienced partners TU A. offers specialized, medium-sized investment aimed at a wide range of financial institutions and private investors the company has the right of it. National and international banks in the debt markets, Finance, Credit Institutions, credit institutions and public institutions, capital markets, investment banks, specialized financial, loan companies, private equity funds, government agencies and major companies in OECD member countries and institutionalized a relationship who is in close contact with PRO-Management Co thanks to this extensive network , international project financing, commercial loans, loan restructuring operates. Overseas loans, long-term, including a grace period of 3 to 5 years can be granted for a term of 15 to 20 years. As a loan overseas loans and financing investment projects can be provided. with knowledge in national and international financial markets, project finance, financial partnerships and innovative financing to Turkish companies competitive loan and credit needs, is working on providing a source of funding.

INPRO-Management Co with Turkish companies, international banks, financing institutions and organizations build a solid bridge between national and international investors, and investors with the most appropriate facilities to provide access to funding sources serves.

Supply From Abroad Finance

IN YOUR PROJECTS, WE PROVIDE CONSULTING SERVICES FOR THE SUPPLY OF EXTERNAL FINANCE. IN THIS REGARD, "WIN - WIN" ISBIRLIKTELIG FELSEFESIYLE..

INPRO-MANAGEMENT ENERGY Finance, Inc. with the changing conditions of business environment at national and international level to the needs and problems that arise as solutions provider was established in 2008.

Globalization and global interdependence in the process of integration with the EU in an environment of transformation and change with the economy developing rapidly in recent years, Turkey has begun to focus on intensely in the international arena.

in accordance with the process of change and development u the INPRO-energy management – finance, other group companies Inc to carry its mission to provide a complementary service to the national and international investors

Each company in the group separately or integrated depending on the situation with national and international clients with effective approaches to solutions.

.

GENERAL ACTIVITY AREAS

• Private Sector

• Public Sector

• Local Administrations

• Industry and trade associations

• EU projects

FIELDS OF ACTIVITY

1.Financial Advisory Services:

-

Development of financial management strategies

-

Analysis of the financial structure and restructuring

-

The quest for finding capital

-

Enterprise risk analysis

-

Consulting in local and international loans

-

Joint-ventures and mergers

-

Project financing support: EU grant programmes - EU Investment Bank, the World Bank

-

The company valuation studies

2. Investment Advisory Services:

-

Investment cost - Profitability Analysis - feasibility studies

-

Economic analysis of existing organizations

-

Sunday (domestic and international) research

-

The pursuit of international strategic alliances

-

Foreign (international) investment consulting

-

Service Company analysis and assessment reports

3.Management Consulting Services:

-

Top management consulting and management development services

-

Corporate Governance (Corporate governance) development of

-

Organizational development and restructuring exercises

-

Strategic Human Resources Management

-

Supply chain planning and management

The management of technological innovation: system design and system development